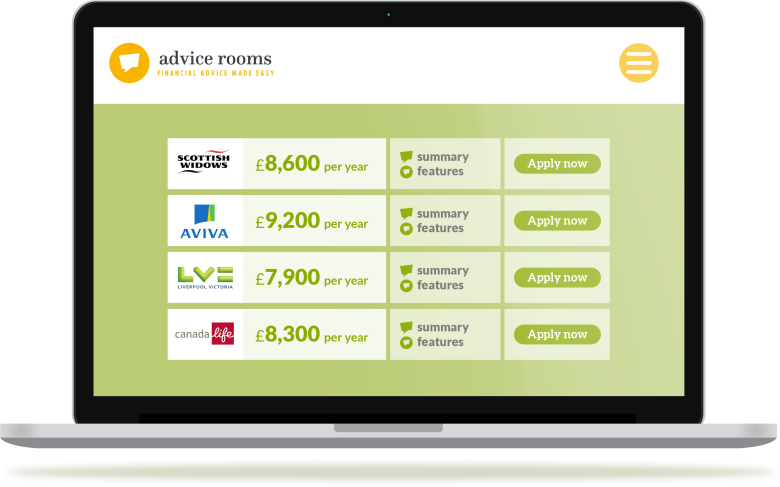

Compare annuity rates

Get a guaranteed annuity for life

- Search all UK providers

- Receive a free quote and compare the market

- Always have an adviser on hand to discuss your options

An annuity can be a great way of securing a guaranteed income in retirement as it will pay a guaranteed amount. There are several factors to consider when determining if an annuity is right for you. These include your current financial situation, your retirement aspirations, your health and whether the annuity value will cover your essential expenditures. Annuity rate comparisons are insightful and help you to decide on the best annuity for your circumstances.

When choosing an annuity, consider the following:

Download our guide and speak to one of our advisers to help you understand if annuities are right for you

Can we help with any your Annuities questions?

Call us

If you would like to speak to an adviser to discuss your options please call:

Opening hours

- Monday – Friday: 9am – 5:30pm

Arrange a call back

Use our contact form

Advice Rooms Knowledge Base

Search our knowledge base for commonly asked questions

Try searching for key words in your question: